We are back with a new topic - Yahoo Finance.

In today's topic, I actually want to show you The best ways to

use Yahoo Finance in 2020!!! step-by-step on website Yahoo Finance.

And I’m going to tell you this like Yahoo

Finance is probably one of the most useful Investments websites. I think it's pretty

underrated as well, like a lot of people use it.

But basically, I want to show

you like a few cool tips and features of how to actually utilize the website. So let's get straight into it.

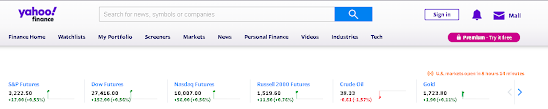

At

the top you're going to see all the market details. So as

you can see there's a Nasdaq stock exchange, there's S&P 500, there's Dow

Jones and there's also Canadian to the US for exchange.

This information is a good

outline because a lot of the stocks when you are trading

they do follow the market patterns.

So meaning that if the market is on the upper trend and if the economy is doing good, that means your stock will most likely be in Korean. So that's essentially called a bullish market.

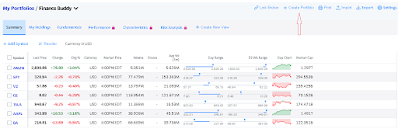

Ideally, all the stocks are going out and the market is going up, about something you need to look out for now at the top right, you're going to see a section where you have your Portfolios.

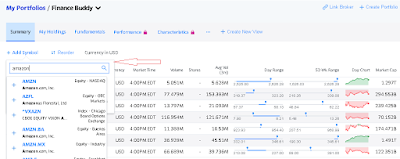

But if you want to add a symbol you can either click add a symbol here so just make sure to click on your portfolio and over here at the bottom you will see a section where it says create your own portfolio.

When once

you've named your portfolio and you go open that up, just

make sure to add the symbol.

The stocks that you kind of

want to watch or maybe the stocks that you're already currently invested in. I just as a courtesy you can take in.

(for

example Amazon Incorporated so it will pop up over here

and also at the top the writer’s corner you can select add a lot).

What that means is essentially when you bought the security and then how

many shares you bought and the cost per share like all that stuffs, click on "My Holdings" where you can select (+Add Lot) this sign.

So that will give you an idea of how well you're performing.

And you've realized games on the specific security so that's kind of cool it really comes handy when you're watching your portfolio can you always

want to make sure you're up to date on all of your stocks so that's one of the

most important rules.

Screeners

Now

under screeners, this is also a convenient very handy tool if you want to essentially like

buy a stock, and you have criteria for it.

But we want our like filter, so you

go to Equity Screeners unless you want to select like an ETF

or a Mutual Fund or something.

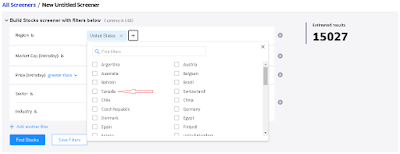

Regions

At

the top you're going to see your region, So this is

basically where the market is. You can either add the United States or you

can even add Canada if that's what you wish to do.

Let's take an example it goes put Canada, I

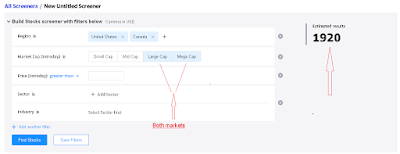

know these are basically market cap industries.

A small-cap is basically smaller companies, mid-cap is medium size, large-cap is basically just larger companies and mega-cap are those companies like Amazon.

So

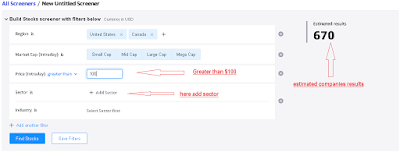

we can select large-cap, for example, and mega-cap, now we have estimated 1920 companies that are the filter that we have applied.

So from you can put

financial services you know a lot of financial services or banks,

there are a lot of Blue Chip

stocks.

You can also add an

industry if you want, for example, Banks. If you can see, we only have three that

are filtered out so click finds stocks.

Basically, you're going to have like one of the top performers like blue-chip mega sensei, mega-cap stocks.

Now

the date change that's actually pretty good, so with the

market increase like these talks is up 6%. It's showing

significant returns.

This is some of the features that you

can use to essentially look like into purchasing better

stocks.

Of

course, what you want to do is, if

you're doing long term and the best thing just make sure to do the fundamental

analysis.

Like all those but that's just a quick tip and the trick that you can utilize yahoo finance or if you want to essentially find and

filter out for companies.

Now, another big thing that I tend to use is I believe it's in the

market data, so you have two categories at the top.

Stock Gainers and Stock Losers-

You

have Stock Gainers, and you

have Stock Losers. If you click stock gainers, you're going to

see the major companies that are performing like the best just for today.

As you can see a lot of

these companies are basically Penny Stocks, which depending on your like area of expertise like

you can definitely get into it.

But

I would definitely recommend doing a lot more research on those companies, make sure to check the Volume. because the volume is probably one of the most essential things

when you're doing B Trading or Penny Stocks.

Heat Map

If

you want to filter it out so you can do as well as you can have a Heat Map. And, if you

click over here you're going to receive the Heat

Map overview and these are basically the top to bottom

type of performer.

You

can really utilize that something comes

probably very handy, you can also do like the losers on

the opposite side.

If you're maybe even Short Selling,

like you could use this category to find the losers stocks

and filter out something like for this specific day, that's pretty helpful I got saying.

You

have World Indices, if

you click over here, basically see how the markets are

doing compared to other markets, so on.

You

guys know like the stocks it's not just limited to Dow Jones or Nasdaq or Toronto

Stock Exchange. There are a lot of different, markets worldwide and Japan and Asia and other countries.

This

is very handy if you want to like compare and see how the markets are performing

and a lot of these markets they're basically in or listed.

So, the meaning that, if

the Chinese Markets are doing good

for the most part, if the economy's been good the US Markets will do so as well.

If the Chinese Markets are doing bad vice-versa

the US Markets can be not doing as good.

This is very helpful just

make sure to look at that also another thing is currencies,

make sure to always keep track of your currencies because if you're Canadian and if you're trading US Stocks or

vice-versa.

And if you buy Canadian Stocks you can actually lose a lot of money on foreign exchange.

So, that's

something you always have to keep a track for it and especially when you're

selling it, because when your conscience you realize your

loss or gain.

Mutual Funds

Mutual

Funds are probably like a cool thing,

I know a lot of you support mutual funds Which I have

nothing against.

You

can see here like this is basically the top to bottom be performers of

different mutual funds, but just make sure to do a lot of

research because mutual funds you want to make sure to read fun facts like all

dive related details, so that's something you can look

into.

Industry News

Industry

News is the other biggest thing that you should for sure to analyze. So let's say if you're

buying bank stocks you want to go into the financial sector.

Above video, the link is sourced by Yahoo Finance (Youtube Channel)

LIVE market coverage: Wednesday, June 17 Yahoo Finance

All the points are covered in this video given below:

- Yahoo finance live stream today

- Yahoo finance tv schedule

- Google finance

- CNBC

- Yahoo finance on the move live

- Yahoo finance portfolio

- Yahoo finance live news

- Yahoo finance news

Right

now, with the Coronavirus, I don't

think it's the greatest situation although the market has been up to today and

just make sure to check up on the latest industry news just to see if how the

performance is at the very bottom.

Where you

can see, there are different alerts, there are different articles that are being liked for it from different-different companies.

Yahoo

Finance we do permanent outlets of different sources which

you can essentially use and that will be very helpful when you're actually

doing like Blogs or Investing.

So those are basically the main features of Yahoo

Finance, let me see if I can find

anything else for you.

If you are trading anything related

to Commodities like Metals, Precious Metals all

that stuff you can look into buying commodities.

But

I think also like one thing to actually use on Yahoo Finance is the calendar feature. So calendar will basically tell you of any

upcoming earnings anything related to like splits IPOs

pricing.

This

is very important, because if you want to take advantage of IPOs. You

can look at the calendar and see what's happening.

For

example, if you click on the 9th of April you're going to see that there's an IPO Event.

Thursday,

the 9th and it is on this specific company and sometimes a

lot in these companies the on IPO.

You can literally make 20% return, it's been a good market a condition so you can look into buying IPOs and so forth.

So

that pretty much sums up the main part of Yahoo Finance, you can I believe I haven't done

this myself but you can also connect your brokerage websites directly to Yahoo Finance.

So that

way if you're essentially like buying stocks you can have it directly reflect

on Yahoo Finance and it's

interconnected it might come in handy especially if your

brokerage service doesn't provide as many resources as this website does.

You

can import stuff export your Portfolio, Watchlist, create new views all that stuff.

And

I would say like out of probably ten stars, I would give

yahoo finance a good eight and a half to nine stars they provide a lot of like

good resources and this will essentially help a lot of investors with keeping

track of their investments learning more and keep in chocolate the market.

Hopefully

you enjoyed this Post (Best way how to use Yahoo Finance in 2020!!! Step-by-Step), I don't want to keep this for too

long but if you do have any questions just make sure to leave them down below

in the comments

Above video link by Yahoo Finance (Youtube Channel)

Warren Buffett and the Berkshire Hathaway Annual Shareholders Meeting 2020 [FULL EVENT]

All the points are covered in this video given below:

- Berkshire hathaway shareholder meeting 2020

- Berkshire hathaway shareholder meeting 2021

- Berkshire hathaway annual meeting 2021

- What happens at the berkshire hathaway annual meeting

- Berkshire hathaway annual meeting transcript 2020

- Berkshire hathaway warren buffett

- Berkshire hathaway investor relations

- Berkshire hathaway annual report