DJIA as a dollar value, Dow's down side index and Dow Jones Industrial Average analysis of its risk and volatility playing the Dow and economy understanding and Dow Jones Industrial Average structure for old investments.

Strategies for new investors protective put less sell call top ten prediction, how to invest ten money, how to buy in Dow Jones options and overview Long Call, Long Bull, Long Call Spread, How to understand long bear put spread.

Invest to 12 Dow Stocks: Today's Dow Johns Index List 2020 Relationships between America's Top 30 Organizations, View DIJ Historical Data Segments and Historical Data from the Year 1985 to November 2019 Through YouTube Videos. 15+ Yahoo Finance DJI or some other very important Questions and Answers of DJIA.

What is The Dow Jones?

It never fails that every day I get the question, “How did the market do?” or “How's the market doing?”. The market that everyone is continually alluding to is the Dow Jones Industrial Average.The Dow (for short) was established May 26, 1896, at first just having 12 organizations from significant American businesses (consequently: "Modern" normal).

The Dow at present mirrors the main 30 U.S. Organizations over its different businesses.

To process the Dow that you find out about every day, a long mathematical recipe is utilized that takes the cost weighted stock cost of each organization and partitions by the "DJIA divisor".

A divisor is a number that is continually acclimated to reflect stock parts, mergers, and profit instalments.

To process the Dow that you find out about every day, a long mathematical recipe is utilized that takes the cost weighted stock cost of each organization and partitions by the "DJIA divisor".

A divisor is a number that is continually acclimated to reflect stock parts, mergers, and profit instalments.

The most well-known analysis of the Dow is that it just speaks to 30 organizations yet it's perceived as "The" market marker.

In spite of the way that the S&P 500 speaks to the best 500 US organizations and is a superior impression of our economy when people ask me about the “market”, I assure you it's not the s&P 500.

Trading Symbol - ^DJI

Type - Large Cap

Market Cap - $8.33 trillion as of Dec 2019

Weighting Method - Price-weighted method

Website - Dow Jones Industrial Average (DJIA)

A presumable contender to join GM is (previous) banking monster Citigroup.

Here is a portion of the more prominent changes in late history:

September 22, 2008: Kraft Foods supplanted AIG (American International Group)

In spite of the way that the S&P 500 speaks to the best 500 US organizations and is a superior impression of our economy when people ask me about the “market”, I assure you it's not the s&P 500.

Trading Symbol - ^DJI

Type - Large Cap

Market Cap - $8.33 trillion as of Dec 2019

Weighting Method - Price-weighted method

Website - Dow Jones Industrial Average (DJIA)

Some Other Related Indices

- Dow Jones Transportation Average

- Dow Jones Utility Average

- Dow Jones Composite Average

- Dow Jones Industrial Average Yield Weighted Index

- Dow Jones Industrial Average Equal Weight Index

When Does a Stock Get Dropped from the Dow?

A stock is dropped from the Dow Jones when it appears justified. As referenced previously, General Motors is ventured to be before long taken out from the Dow particularly if it petitions for financial protection.A presumable contender to join GM is (previous) banking monster Citigroup.

Here is a portion of the more prominent changes in late history:

September 22, 2008: Kraft Foods supplanted AIG (American International Group)

February 19, 2008: Chevron and Bank of America supplanted Altria Group and Honeywell

April 8, 2004: Pfizer, Verizon, and AIG supplanted International Paper, AT&T, and Eastman Kodak

Looking a gander at past substitutions, commonly the Dow doesn't supplant a leaving organization with another in its a similar industry. Presently, there are a few hypotheses on which organization will supplant them.

A couple of conceivable outcomes incorporate Cisco, Visa, Amazon, Wells Fargo, and mother Google. The reality of the situation will become obvious eventually.

April 8, 2004: Pfizer, Verizon, and AIG supplanted International Paper, AT&T, and Eastman Kodak

Who Will Replace GM?

There aren't any preset principles on how an organization gets supplanted on the Dow.Looking a gander at past substitutions, commonly the Dow doesn't supplant a leaving organization with another in its a similar industry. Presently, there are a few hypotheses on which organization will supplant them.

A couple of conceivable outcomes incorporate Cisco, Visa, Amazon, Wells Fargo, and mother Google. The reality of the situation will become obvious eventually.

Update: Cisco and Traveler's Co. will supplant GM and Citi toward the finish of exchanging on June 8, 2009.

What is the Calculation of DJIA and How Does the Dow Jones Work?

To show how this utilization of the divisor functions, we will make a file, the Investopedia Mock Average (IMA). The IMA is made out of 10 stocks, which complete $1,000 when their stock costs are included.

The IMA cited in the media is along these lines 100 ($1,000 ÷ 10). Note that the divisor in our model is 10.

Presently, suppose that one of the stocks in the IMA normal trades at $100 but undergoes a 2-for-1 split, reducing its stock price to $50.

If our divisor remains unchanged, the calculation for the average would give us 95 ($950 ÷ 10).

If our divisor remains unchanged, the calculation for the average would give us 95 ($950 ÷ 10).

- This would not be accurate because the stock split merely changed the price, not the value of the company.

- To compensate for the effects of the split, we have to adjust the divisor downward to 9.5.

- This way, the index remains at 100 ($950 ÷ 9.5) and more accurately reflects the value of the stock in the average.

- If you are keen on finding the current Dow divisor, you can discover it on the site of the Dow Jones Indexes and the Chicago Board of Trade.

The DJIA as a Dollar Value

To make sense of how an adjustment in a specific stock influences the file, isolate the stock's value change by the current divisor.

For instance, if Walmart (WMT) is up to $5, separate five by the current divisor (0.147), which approaches 34.01.

Subsequently, if the DJIA was up 100 focuses on the day, Walmart was liable for 34.42 purposes of the development.

Gauging the Index

The DJIA's philosophy of figuring a file is known as the cost weighted technique. Organizations are positioned dependent on their offer costs.

On the head of managing stock parts, the drawback to this technique is that it doesn't mirror the way that a $1 change for a $10 stock is considerably more noteworthy (rate savvy) than a $1 change for a $100 stock.

Due to value weightings related issues, most other major files, for example, the S&P 500, are market-capitalization-weighted-that is, organizations are positioned by the number of outstanding shares they have, multiplied by the value per share.

The Downside of the Dow

That is just a single disadvantage of the DJIA. Another mirrors the way that today the securities exchange is considerably more geologically scattered and divided by organization size and industry.

During the mid-1900s, the Industrial Revolution prodded the production of enormous mechanical sort organizations, huge numbers of which were situated in the U.S., that was illustrative of the general economy.

During the mid-1900s, the Industrial Revolution prodded the production of enormous mechanical sort organizations, huge numbers of which were situated in the U.S., that was illustrative of the general economy.

However, with the mechanical advances and the methodology of the web, the expansion of organizations was multi-crease, and the formation of or the increment in the quantity of financially significant businesses with organizations found anyplace on the planet, has moulded a market which is totally interconnected and associated.

Due to the divided, worldwide nature of the present market, many feel the Dow isn't a fitting marker of the general economy.

The Dow and the Economy

Despite its impediments, the Dow actually serves three significant capacities in the present commercial centre:

1. The long history of the Dow fills in as a token of and correlation for the present market as compared to early markets.

Trend the investigation is consistently significant when attempting to estimate the future and the life span of the Dow fills this need in a way that is better than all different records.

2. While the Dow tracks just 30 huge American organizations, these organizations are comprehensive of all industries except utilities and transportation, making a wide diagram of the economy.

In general, the financial exchange is the main pointer and the pattern of the Dow could be interpreted as speaking to the pattern of the economy throughout the following year.

It might not have prescient force in finding out the degree of monetary action yet ought to have the option to have directional consistency.

3. The Dow collects an obvious and maybe unjustifiable measure of consideration from the media.

Investigating how the Dow fared on a specific day is inescapable and it is utilized as an intermediary for the condition of the economy.

So in spite of the way that the Dow isn't completely illustrative of a worldwide, innovation-driven market, the mental association of it with the condition of the economy is significant.

So in spite of the way that the Dow isn't completely illustrative of a worldwide, innovation-driven market, the mental association of it with the condition of the economy is significant.

List of Symbols Similar to DJI

Understanding and Playing the Dow Jones Industrial Average

It is one of the most firmly followed securities exchange lists on the planet.

Regardless of the way that the Dow, as it's usually known, is viewed by a huge number of individuals consistently, a considerable lot of its watchers neither comprehend what the Dow truly quantifies or speaks to nor do they understand how to capitalize on the information provided to them.

Let's take a gander at the structure of the Dow, a significant sort of speculation vehicle that recreates the presentation of the Dow, and three venture procedures you can use to support your insight and total assets.

Structure of the Dow Jones Industrial Average

The DJIA was made in 1896, also, it is the second-most established securities exchange list in the U.S.; the Dow Jones Transportation Average started things out.

(For a more definite history, see "When Was the Dow Jones Industrial Average First Calculated?").

Just has a more seasoned history. The DJIA comprises of 30 enormous top blue-chip organizations that are, for the most part, household names.

Ironically, the DJIA is not, at this point a genuine intermediary for the industrials division in light of the way that lone a small amount of the organizations that make up the Dow are named industrials.

The remainder of the organizations is allotted to one of the rest of the divisions found in the Global Industry Classification System. The main part that isn't spoken to by an organization in the DJIA is the utility sector.

The remainder of the organizations is allotted to one of the rest of the divisions found in the Global Industry Classification System. The main part that isn't spoken to by an organization in the DJIA is the utility sector.

Notwithstanding the area variety of the Dow, further, expansion is given by the worldwide tasks of its constituents.

This implies financial specialists can increase aberrant presentation to the worldwide business sectors, and utilize the worldwide expansion of the organizations in the record to fence against the negative effect of a frail U.S. economy.

Additionally, the organizations that make up the Dow produce a lot of income every year. This assists in lessening the business danger of the organizations that make up the list.

Additionally, the organizations that make up the Dow produce a lot of income every year. This assists in lessening the business danger of the organizations that make up the list.

Analysis of the Dow Jones Industrial Average

While the DJIA has numerous amazing ascribes, perhaps the greatest analysis comes from the way that it is a cost weighted list.

This implies each organization has relegated a weighting dependent on its stock cost. In an examination, most organizations that make up a file are weighted by their market capitalization.

The S&P 500, an index that is different from the DJIA in many ways, is a genuine case of this.

The S&P 500, an index that is different from the DJIA in many ways, is a genuine case of this.

As you can expect, there would be a noteworthy contrast in the weighting of the organizations in the Dow if the file board utilized market capitalization rather than a stock cost to structure the file intermediary.

Taking everything into account, there is actually nothing that makes a cost weighted file substandard compared to a market-top weighted file, or even a similarly weighted record or an income weighted list.

This is on the grounds that the eccentric idea of each list development strategy has numerous qualities and shortcomings that make it hard to arrive at an agreement on the best technique to utilize.

This is on the grounds that the eccentric idea of each list development strategy has numerous qualities and shortcomings that make it hard to arrive at an agreement on the best technique to utilize.

An Important Distinction Between Risk and Volatility

When breaking down the presentation of the Dow, it is essential to remember that it is considered by some to be an unpredictable file.

Subsequently, numerous speculation experts won't ordinarily suggest putting resources into items that track the DJIA.

All things considered, there is a noteworthy contrast between the business danger of the organizations that make up the Dow and the instability of the record.

All things considered, there is a noteworthy contrast between the business danger of the organizations that make up the Dow and the instability of the record.

This is on the grounds that the organizations that make up the DJIA speak to 30 of the most settled organizations on the planet. In this manner, their business hazard is generally low since it is improbable that they will fail.

In light of everything, the stock cost of these organizations can vary extraordinarily over brief periods. Subsequently, speculation items that repeat the exhibition of the Dow can encounter noteworthy momentary increases and misfortunes.

Old Investment Strategies for New Investors

It must comprehend that there is the potential for outrageous misfortunes if they put resources into items attached to the Dow.

Therefore, the accompanying methodologies are not for unpracticed budgetary experts who need to utilize an "invest and forget it" approach.

In light of everything, there are a large group of methodologies that you can utilize that are better than the procedures promoted by most budgetary guides.

In any case, these methodologies likewise require an adjustment in theory, from the basic purchase and-hold mindset to procedures that have a lot shorter time skyline.

In any case, these methodologies likewise require an adjustment in theory, from the basic purchase and-hold mindset to procedures that have a lot shorter time skyline.

Such strategies include:

Protective Put

A defensive put methodology comprises of a long situation in a Dow trade exchanged store (ETF) and the acquisition of put choices on a similar basic ETF.

This procedure will pay off if the DJIA goes up, and will ensure your venture in the event that the DJIA goes down.

Short Selling

Interestingly, financial specialists can actualize a defensive short undercutting procedure by selling the Dow ETF and purchasing call choices on a similar basic ETF.

This methodology will pay off if the DJIA goes down and will ensure your speculation in the event that the DJIA goes up.

Secured Call

Finally, financial specialists can create an unobtrusive premium on the head of a long Dow ETF position by actualizing a secured call technique.

This system involves purchasing the DJIA ETF and selling call alternatives on a similar hidden ETF. This technique will benefit if the Dow remains generally level, and doesn't surpass the strike cost of the call alternatives sold.

This system involves purchasing the DJIA ETF and selling call alternatives on a similar hidden ETF. This technique will benefit if the Dow remains generally level, and doesn't surpass the strike cost of the call alternatives sold.

Taking everything into account, there is no drawback insurance gave by a secured call system, so financial specialists must be certain that the Dow will stay level before actualizing this methodology.

The advantage of these techniques is that financial specialists can choose the measure of danger that they need to take, or the additional superior that they need to get, by building up the strike cost on the put or call options that they use.

As you can see from these models, subsidiaries can be used to moderate or take out the danger of misfortune on a venture, and they can be used to create an unassuming danger-free pace of return.

As you can see from these models, subsidiaries can be used to moderate or take out the danger of misfortune on a venture, and they can be used to create an unassuming danger-free pace of return.

In light of these techniques alone, it ought to be evident that subordinate instruments are not "weapons of money related mass annihilation" - in any event not in case they are utilized properly by skilled financial specialists.

Top Ten

This technique includes putting equivalent sums in the 10 stocks on the DJIA with the most elevated profit yield toward the beginning of a year and holding them until year-end, at which time the financial specialist sells that year's stocks and sends the returns into the new stocks for the year ahead.

This procedure has commonly created great outcomes after some time.

Forecasting the Dow

Now that your emphasis is on the Dow, and you know the sort of speculation vehicle that you should utilize and the proper venture technique to use in each kind of market climate, the following two inquiries that you should pose are:

"How might I decide whether the current degree of the DJIA is underestimated, genuinely esteemed or exaggerated, and how might I figure out which bearing the DJIA is likely to move?"

Tragically, there is no certain method to gauge the future course of the business sectors.

In any case, financial specialists can evaluate the charges related to the alternatives attached to the Dow ETF to measure the current perspective on the foreseen unpredictability in the market.

In any case, financial specialists can evaluate the charges related to the alternatives attached to the Dow ETF to measure the current perspective on the foreseen unpredictability in the market.

This assurance ought to be founded on the cost of the choices, where higher alternative charges are characteristic of higher suggested unpredictability in the market.

What's more, financial specialists can utilize the cost of the alternatives attached to the Dow to decide the breakeven sum on the DJIA ETF.

By utilizing these methodologies, financial specialists can decide whether the current danger in the Dow merits market cooperation.

By utilizing these methodologies, financial specialists can decide whether the current danger in the Dow merits market cooperation.

Additionally, if you are happy to set aside the effort to investigate the recorded scope of the stock costs related with the segments that make up the Dow, and afterwards survey the market products of the organizations that make up the Dow, you ought to have the option to accurately gauge the valuation level of the index, and therefore, its potential volatility.

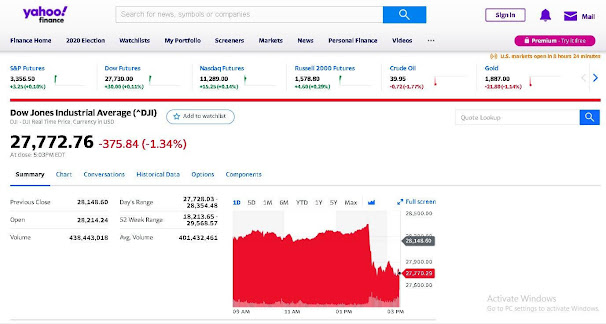

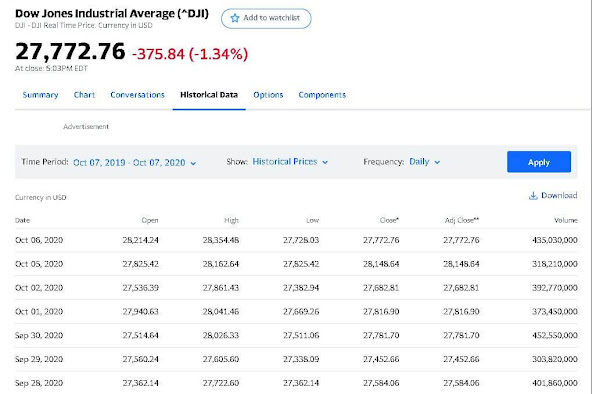

DJI-Daily Updated Historical Data

Finally, by using this approach, you should also be able to gauge the direction the Dow is trending, the appropriate strategy to employ and the risk and potential profit that you stand to makeover your investment time horizon.How To Buy Options On the Dow Jones

If you have restricted capital however need to exchange the Dow, DIA ETF alternatives may be a decent approach, accepting you likewise comprehend the dangers engaged with choices exchanging.

Peruse on to perceive how to purchase and use alternatives to exchange the Dow Jones.

The Dow Jones record is a well known financial exchange list speaking to 30 huge and compelling American organizations.

Purchasing and selling the record straightforwardly is awkward and can require a lot of capital and complexity.

Purchasing and selling the record straightforwardly is awkward and can require a lot of capital and complexity.

Utilizing ETF alternatives on the DIA, you can exchange the Dow all the more effectively and cost-effectively while keeping your risk management.

Options Basics & Overview

For the purposes of what follows, we will look at historical examples using DIA options that expired back on September 2015.

We take this model since that lapse date came short of what one month after the August 2015 "smaller than usual blaze crash", a market occasion that lifted the CBOE Market Volatility Index (VIX) over 50 unexpectedly since 2009? greatly influencing pricing on the September 2015 contracts.

The accentuation here will be on purchasing (or going "long") alternatives so your danger is restricted to the superior paid for the choices, instead of procedures that include composing (or going “short”) options.

Specifically, we centre around the accompanying choice systems:

Specifically, we centre around the accompanying choice systems:

- Long Call

- Long Put

- Long Bull Call Spread

- Long Bear Put Spread

Note that the following models don't consider exchanging commissions, which can fundamentally add to the expense of

an exchange.

DIA Long Call

System: Long Call on the DJIA ETF (DIA)

Rationale: Bullish on the hidden list (DJIA)

Option chose: September '15 $184 Call

Current Premium (offer/ask): 3.75/$4.00

Maximum Risk: $4.00 (i.e., the alternative premium paid)

Break-even: DIA cost of $187 by choice expiry

Potential Reward: (Prevailing DIA cost - earn back the original investment cost of $188)

Maximum Reward: Unlimited

If you are bullish on the Dow, you could start a long position (for example purchase) a call alternative.

The all-time high on the DIA back at that time was $183.35, which was reached on May 20, 20153? -- the same day that the DJIA index opened at a peak of 18,315.10.4?

If you believed that the cost would keep on rising, the following most noteworthy strike cost would be $184.

A strike cost of $184 just implies that you would have the option to purchase DIA shares at $184, regardless of whether the market price was higher at or before expiration.

In case the DIA units shut beneath $184 - which compares to a Dow Jones level of around 18,400 - by choice expiry, you would have just lost the premium of $4 per choice that you paid for the calls.

Your equal the initial investment cost on this alternative the position is $188 (i.e., the strike cost of $184 + $4 premium paid).

This means if the Diamonds shut precisely at $188 on September 18, the calls would expire at exactly $4, which is the price that you paid for them.

This means if the Diamonds shut precisely at $188 on September 18, the calls would expire at exactly $4, which is the price that you paid for them.

Accordingly, you would recover the $4 premium paid when you purchased the calls, and your lone expense would be the commissions paid to open and close the alternative position.

Past the equal the initial investment purpose of $188, the potential benefit is hypothetically boundless.

In the event that the Dow took off to 20,000 preceding termination, the DIA units would go for about $200, and your $184 call would ascend to $16, a clean $12 benefit or 300% addition on your call position.

In the event that the Dow took off to 20,000 preceding termination, the DIA units would go for about $200, and your $184 call would ascend to $16, a clean $12 benefit or 300% addition on your call position.

DIA Long Put

Strategy: Long Put on the DJIA ETF (DIA)

Rationale: Bearish on the fundamental file (the DJIA)

Option chose: September'15 $175 Put

Current Premium (offer/ask): $4.40/$4.65

Maximum Risk: $4.65 (i.e., the choice premium paid)

Break-even: DIA cost of $170.35 by alternative expiry

Potential Reward: (Break-even price of $170.35 - Winning DIA value)

Maximum Reward: $170.35.

If you were instead bearish, you could start a since quite a while ago put position.

In the model depicted above, you would be searching for the Dow to decay to in any event 17,500 by alternative expiry, speaking to a 4.9% drop from the most punctual beginning stage level of 18,400.

If In case the DIA units shut above $175 - which relates to a Dow Jones level of around 17,500 - by choice expiry, you just would have lost the premium of $4.65 that you paid for the puts.

Your make back the initial investment cost on this choices position is $170.35 (i.e., the strike cost of $175 less $4.65 premium paid). In this manner, if the Diamonds shut precisely at $170.35 at termination, the calls would trade at your purchase price of $4.65.

If you sold them at that value, you would earn back the original investment, with the main expense acquired being the commissions paid to open and close the choice position.

Underneath the equal the initial investment purpose of $170.35, the potential benefit is hypothetically a limit of $170.35, which would occur in the almost unthinkable occasion of the Diamonds dropping right to $0 (which would require the DJIA file to likewise be exchanging at zero!).

Underneath the equal the initial investment purpose of $170.35, the potential benefit is hypothetically a limit of $170.35, which would occur in the almost unthinkable occasion of the Diamonds dropping right to $0 (which would require the DJIA file to likewise be exchanging at zero!).

Your put position would at present bring in cash if the Diamonds are exchanging at any level underneath $170.35 at lapse, which relates to a record level of around 17,035.

Suppose the Dow Jones plunged to 16,500 by lapse. The Diamonds would exchange at $165, and the $175 puts would be evaluated around $10, for a potential $5.35 benefit or 115% increase on your put position.

DIA Long Bull Call Spread

Strategy: Long Bull Call Spread on the DJIA ETF (DIA)

Rationale: Bullish on the Dow Jones, yet need to decrease premium paid

Options chose: September $184 Call (long) and September $188 Call (short)

Current Premium (offer/ask): 3.75/$4.00 for $184 Call and $1.99/$2.18 for $188

Call Most extreme Risk: $2.01 (i.e., the net choice Long Bull Call Spread cost of $186.01 by alternative expiry

Most extreme Reward: $4 (i.e., the distinction between the call strike costs) less net premium paid of $2.01.

The bull call spread is a vertical spread technique that includes starting a long situation on a call choice and a concurrent short situation on a call choice with a similar termination yet at a higher strike cost.

The target of this system is to benefit from a bullish view on the basic security, however at a lower cost than an inside and out long call position. This is accomplished through the exceptional got on the short call position.

In this model, the net premium paid is $2.01 (i.e., the excellent paid of $4 for the $184 long call position less the exceptional got of $1.99 on the short call position).

In this model, the net premium paid is $2.01 (i.e., the excellent paid of $4 for the $184 long call position less the exceptional got of $1.99 on the short call position).

Note that you pay the inquire price when you buy or go long on an option, and receive the bid price when you sell or go short on an option.

Your equal the initial investment cost in this model is $186.01 (i.e., the strike cost of $184 on the long call + $2.01 in net premium paid).

In case the Diamonds are exchanging at state $187 by choice expiry, your gross increase would be $3, and your net addition would be $0.99 or 49%.

The most extreme gross increase you can hope to settle on this decision spread is $4. Suppose the Diamonds are exchanging at $190 by choice expiry.

The most extreme gross increase you can hope to settle on this decision spread is $4. Suppose the Diamonds are exchanging at $190 by choice expiry.

You would have an addition of $6 on the long $184 call position, however, lost $2 on the short $188 call position, for a general increase of $4. The net increase for this situation, in the wake of taking away the $2.01 net premium paid, is $1.99 or 99%.

The bull call spread can fundamentally diminish the expense of an alternative position, however, it additionally tops the potential reward.

DIA Long Bear Put Spread

Strategy: Long Bear Put Spread on the DJIA ETF (DIA)

Rationale: Bearish on the Dow Jones, yet need to lessen premium paid

Options chose: September $175 Put (long) and September $173 Put (short)

Current Premium (offer/ask): $4.40/$4.65 for $175 Put and $3.85/$4.10 for $173

Put Maximum Risk: $0.80 (i.e., the alternative premium paid)

Break-even: DIA cost of $174.20 by choice expiry

Maximum Reward: $2 (i.e., the contrast between the call strike costs) less net premium paid of $0.80.

The bear put spread is a vertical spread system that includes starting a long situation on a put choice and a concurrent short situation on a put choice with a similar lapse yet a lower strike cost.

The justification for utilizing a bear put spread is to start a bearish situation at a lower cost, in return for a lower expected increase.

The justification for utilizing a bear put spread is to start a bearish situation at a lower cost, in return for a lower expected increase.

The greatest danger in this model is equivalent to the net premium paid of $0.80 (i.e., $4.65 premium paid for the long $175 Put less $3.85 premium got for the short $173 Put).

The most extreme gross increase is equivalent to the $2 distinction in the put strike costs, while the greatest net addition is $1.20 or 150%.

Approaches to Invest in the DJIA

There are various approaches to place assets into the Dow Jones Industrial Average.

The most evident is to purchase portions of the organizations it incorporates.

But Yet, a few trades exchanged assets (ETFs) likewise track the value developments of the Dow, including the SPDR Dow Jones Industrial Average ETF (DIA), Elements Dow Jones High Yield Select 10 Total Return Index (DOD), and ProShares Ultra Dow30 (DDM).

But Yet, a few trades exchanged assets (ETFs) likewise track the value developments of the Dow, including the SPDR Dow Jones Industrial Average ETF (DIA), Elements Dow Jones High Yield Select 10 Total Return Index (DOD), and ProShares Ultra Dow30 (DDM).

Why the Dow Matters

The Dow Jones Industrial Average (DJIA) is one of the most cited budgetary gauges on the planet and has gotten inseparable from the money related business sectors by and large.

At the point when individuals state the market has gone up or somewhere near a specific number of focuses, there's a decent possibility they're alluding to changes in the Dow.

Charles Dow, the creator of the DJIA, devised his first stock index in 1884.1? It comprised of two promoted modern and 12 promoted railroad organizations.

Dow's goal was to follow U.S. monetary quality by intently watching the organizations viewed as the foundation of the U.S. economy.

In 1886, Dow adjusted the file to contain 10 railways and two industrials.

In 1886, Dow adjusted the file to contain 10 railways and two industrials.

During the 1890s, Dow perceived the developing significance of the modern area in the U.S. economy and again adjusted the file, this opportunity to comprise exclusively of modern stocks.

The primary form of the DJIA, which contained 12 stocks, showed up in The Wall Street Journal on May 26, 1896.

Coming up next are the first 12 Dow stocks:

- American Cotton Oil

- American Sugar

- American Tobacco

- Chicago Gas

- Refining and Cattle Feeding

- General Electric

- Laclede Gas

- National Lead

- North American

- Tennessee Coal and Iron

- U.S. Cowhide PDF.

- The U.S.

While an odd-looking blend by today's monetary guidelines, these 12 stocks were painstakingly picked to represent the major areas of the U.S. economy at the time.

The 30-stock Dow Jones Industrial Average debuted in 1928. Since then, it has changed over the years as some stocks were removed and others added to maintain an accurate reflection of the U.S. economy.

Of the first 12 Dow stocks, General Electric (GE) is the one in particular that stood the trial of time was still in the list until it was taken out in 2018.

There are additionally two other Dow midpoints, the Dow Jones Utility Average (DJUA) also, the Dow Jones Transportation Average (DJTA), which comprises of stocks in the railroad, shipping, delivery, and carrier businesses.

There are additionally two other Dow midpoints, the Dow Jones Utility Average (DJUA) also, the Dow Jones Transportation Average (DJTA), which comprises of stocks in the railroad, shipping, delivery, and carrier businesses.

Today's Dow

Thinking about the expansiveness of the present economy, one may erroneously accept that a record comprising of a simple 30 stocks could scarcely be of any worth. That is basically false.

Notwithstanding speaking to 30 of the most exceptionally promoted and persuasive organizations in the U.S. economy, the Dow is likewise the budgetary media's most referred to U.S. market list and stays a decent pointer of general market patterns.

On August 24, 2020, Salesforce, Amgen, furthermore, Honeywell was added to the Dow, supplanting ExxonMobil, Pfizer, furthermore, Raytheon Technologies.

In case one thinks about an evaluating graph of the Dow with an outline of the Wilshire 5000, the most comprehensive of all U.S. files, it is apparent that the two have followed incredibly comparable ways.

The Dow has generally started to decay for expanded periods before the more theoretical Nasdaq record, an example that happened in the securities exchange slumps that started in April of 1998, January of 2000, December of 2001, January of 2004, December of 2004, and October of 2007.

Some accept that when loads of DJIA organizations start to show shortcoming, the U.S. economy might be set out toward a log jam.

Top 30 Organizations of the US in the DOW JONES Index List 2020

To facilitate your perusing in this extensive rundown, here are quick connections to go legitimately to the subtleties of any of the Dow companies.

1. Microsoft

Microsoft Logo

Division: Information Technology

Industry: Systems Software

Market Cap.: $ 1,428 Billion approx

Stock Symbol: MSFT

Website: microsoft.com

Microsoft Corporation is a worldwide innovation organization creating, fabricating, permitting, supporting, and selling PC programming, most strikingly the Windows working frameworks, the Microsoft Office suite, Internet Explorer and Edge internet browsers.

It is additionally associated with customer electronics with the Xbox Video game consoles, contact screen PCs with Microsoft Surface, and related services.

2. Apple

Apple logo

Sector: Data Technology

Industry: Technology Hardware, Storage and Peripherals

Market Cap.: $ 1,400 Billion

Stock Symbol: AAPL

Website: apple.com

Apple Inc. plan, produces, and markets cell phones and media gadgets, PCs, quite the iPhone, iPad, Mac, iPod, Apple Watch, and Apple TV.

The organization additionally considers and sells a scope of related programming and administrations:

- The iPhone OS (iOS),

- OS X and watchOS working frameworks,

- iCloud, and

- Apple Pay.

Apple likewise sells frill, uphold contributions, and outsider advanced substance and applications.

3. Visa

Visa logo

Sector: Data Technology

Industry: Data Processing and Outsourced Services

Market Cap.: $ 449.3 Billion

Stock Symbol: V

Site: usa.visa.com

Visa Inc., is a global monetary administrations company encouraging electronic subsidizes moves all through the world.

It works instalment items that monetary establishments use to offer credit, charge, paid ahead of time and money access projects to their clients by means of Visa-marked Mastercards, gift vouchers, and check cards.

4. JPMorgan

JPMorgan Chase and Co. logo

Sector: Financials

Industry: Diversified Banks

Market Cap.: $ 423 Billion

Stock Symbol: JPM

Site: jpmorganchase.com

JPMorgan Chase and Co. is a global venture bank and money related administrations organization settled in New York City.

With roots going back to 1799, JPMorgan Chase has gotten one of the world's biggest general bank working around the world.

It is associated with retail and business just as in speculation banking, resource the executives, private banking, private riches the board, and depository administrations.

5. Johnson & Johnson

Johnson & Johnson logo

Sector: Medical care

Industry: Pharmaceuticals

Market Cap.: $ 398.6 Billion

Stock Symbol: JNJ

Site: jnj.com

Johnson and Johnson is a global medicine, emergency treatment supplies, and shopper bundled products manufacturing and sales company founded in 1886.

Refocusing various acclaimed brands, Johnson and Johnson line of items remarkably incorporate Band-Aid, Tylenol, Johnson's infant items, Neutrogena, Clean and Clear, and Acuvue.

6. Walmart

Walmart logo

Sector: Customer Staples

Industry: Hypermarkets & Super Centers

Market Cap.: $ 330.4 Billion

Stock Symbol: WMT

Site: corporate.walmart.com

Walmart Inc. is a global retail corporation operating a chain of hypermarkets, markdown retail establishments, and staple stores.

Walmart is the world's biggest organization by income, utilizing more than 2.3 million individuals in 28 nations.

7. Procter & Gamble

Procter & Gamble logo

Sector: Consumer Staples

Industry: Personal Products

Market Cap.: $ 311.3 Billion

Stock Symbol: PG

Site: us.pg.com

Established in 1837, the Procter and Gamble Company, otherwise called P&G, is a worldwide purchaser merchandise organization giving a wide scope of individual wellbeing/buyer wellbeing and individual consideration and cleanliness items in the sections of excellence, prepping, medical services, texture and home, and infant, ladylike and family care.

8. Intel

Intel logo

Sector: Data Technology

Industry: Semiconductors

Market Cap.: $ 281.3 Billion Stock Symbol: INTC

Website: intel.com

Intel Corporation, normally known as Intel, is a worldwide partnership and innovation organization, particularly associated with the creation and deals of microchips and semiconductor chips driving PCs.

Intel additionally enhances different advances, including cloud, Internet of Things, PC memory and 5G-availability.

9. UnitedHealth Group

UnitedHealth Group logo

Sector: Medical services

Industry: Managed Health Care

Market Cap.: $ 274 Billion

Stock Symbol: UNH

Site: unitedhealthgroup.com

UnitedHealth Group is the biggest medical services organization on the planet by income, offering diversified medical care items and protection administrations.

It serves clients through two particular stages:

United Healthcare which gives medical care inclusion and advantages services, and Optum which gives data and innovation empowered wellbeing administrations.

10. ExxonMobil

Exxon Mobil logo

Sector: Energy

Industry: Integrated Oil and Gas

Market Cap.: $ 260.3 Billion

Stock Symbol: XOM

Site: corporate.exxonmobil.com

ExxonMobil Corporation, all the more regularly known as ExxonMobil, is the world's biggest energy organization, working in the exploration, production, transportation, and offer of crude oil and natural gas.

ExxonMobil is likewise occupied with the assembling, transportation, and offer of oil based goods, markets ware petrochemicals, and a scope of claim to fame items.

11. Home Depot

The Home Depot logo

Sector: Purchaser Discretionary

Industry: Home Improvement Retail

Market Cap.: $ 259.6 Billion

Stock Symbol: HD

Site: homedepot.com

The Home Depot Inc. is a retailing organization that sells devices, home improvement supplies, development items, and administrations.

Home Depot is the biggest home improvement retailer in the United States, additionally working in Canada and Mexico.

12. Disney

The Walt Disney Company logo

Sector: Correspondence Services

Industry: Movies & Entertainment

Market Cap.: $ 257 Billion

Stock Symbol: DIS

Website: thewaltdisneycompany.com

Established in 1923, the Walt Disney Company, ordinarily known as Disney, is enhanced worldwide broad communication and amusement aggregate.

It is quite engaged with film studios through Walt Disney Studios and 21st Century Fox.

Other fundamental divisions incorporate Walt Disney parks, encounters and customer items, Disney Media Networks which possesses and works satellite telecom companies (ABC broadcast organization, Disney Channel, ESPN, A&E Networks and Freeform).

Other fundamental divisions incorporate Walt Disney parks, encounters and customer items, Disney Media Networks which possesses and works satellite telecom companies (ABC broadcast organization, Disney Channel, ESPN, A&E Networks and Freeform).

And the new Disney+ video-on-request administration, prominently dispatched to grow better approaches to adapt the organization's substance and compete against Netflix, and other VOD services.

13. The Coca-Cola Company

Coca-Cola logo

Sector: Consumer Staples

Industry: Soft Drinks

Market Cap.: $ 253.9 Billion

Stock Symbol: KO

Site: coca-colacompany.com

Founded in 1886, the Coca-Cola Company is engaged with the assembling, retail, and showcasing of nonalcoholic refreshment concentrates and syrups.

It is essentially known for its shimmering soft drinks including:

- Coca-Cola,

- Diet Coke,

- Fanta, and

- Sprite.

But at the same time is occupied with still refreshments, for example, waters, juices, and juice drinks, prepared to-drink teas and espressos, beverages, dairy and caffeinated drinks.

14. Verizon

Verizon logo

Sector: Correspondence Services

Industry: Integrated Telecommunication Services

Market Cap.: $ 247.9 Billion

Stock Symbol: VZ

Site: verizon.com

Verizon Communications Inc., commonly known as Verizon, is an expanded global media communications combination.

Verizon is occupied with a scope of correspondences fragments, including 5G, remote organizations, broadband and fiber, media and innovation, Internet of Things and director security.

15. Merck and Co.

Merck logo

Sector: Medical care

Industry: Pharmaceuticals

Market Cap.: $ 216.6 Billion

Stock Symbol: MRK

Site: merck.com

Merck and Company, Inc., known as Merck Sharp and Dohme, or MSD, outside the United States and Canada, is one of the biggest drug organizations on the planet.

Founded in 1891 in the US, and free since World War I from its parent organization, presently probably the biggest organization in Germany, Merck gives professionally prescribed drugs, immunizations, biologic treatments, and creature wellbeing items.

16. Pfizer

Pfizer logo

Sector: Medical services

Industry: Pharmaceuticals

Market Cap.: $ 210.6 Billion

Stock Symbol: PFE

Website: pfizer.com

Pfizer Inc. is one of the world's biggest drug organizations, creating and delivering assorted meds and antibodies.

Its driving items incorporate are:

Its driving items incorporate are:

- Lipitor (to bring down LDL blood cholesterol),

- Lyrica (for neuropathic torment and fibromyalgia),

- Diflucan (an antifungal medicine),

- Zithromax (anti-toxin),

- Viagra (for erectile brokenness), and

- Celebrex (a mitigating drug).

17. Chevron

Chevron logo

Sector: Energy

Industry: Integrated Oil and Gas

Market Cap.: $ 206 Billion

Stock Symbol: CVX

Site: chevron.com

Chevron Corporation is an energy global organization associated with each part of the oil, gaseous petrol, and geothermal energy industries in more than 180 countries.

Chevron works in hydrocarbon investigation and creation, hydrocarbon refining, advertising and transport, synthetic compounds assembling and deals, and force age.

Chevron works in hydrocarbon investigation and creation, hydrocarbon refining, advertising and transport, synthetic compounds assembling and deals, and force age.

18. Cisco

Cisco logo

Sector: Data Technology

Industry: Communications Equipment

Market Cap.: $ 204.5 Billion

Stock Symbol: CSCO

Site: cisco.com

Cisco Systems, Inc. is a worldwide innovation aggregate creating, assembling and selling organizing equipment, broadcast correspondences equipment, and other high-advancement organizations and things.

Through its numerous auxiliaries, Cisco is additionally work in Internet-of-Things, space security, and energy the board.

19. Boeing

Boeing logo

Sector: Industrials

Industry: Aerospace and Defense

Market Cap.: $ 196.5 Billion

Stock Symbol: BA

Site: boeing.com

The Boeing Company is one of the world's biggest aeroplane producers and guard temporary worker also, it is the biggest exporter in dollar estimation of the United States.

Established in 1916, Boeing is associated with the plan, fabricating, and overall deals of planes, rotorcraft, rockets, satellites, and rockets; it likewise gives renting and item uphold administrations.

20. McDonald's

McDonald's logo

Sector: Shopper Discretionary

Industry: Restaurants

Market Cap.: $ 158.2 Billion

Stock Symbol: MCD

Site: corporate.mcdonalds.com

Founded in 1940 as a café, McDonald's has developed to turn into a main cheap food establishment.

As Starting at 2016, McDonald's was the world's biggest café network by income, serving more than 69 million clients day by day in excess of 36,900 outlets, situated in excess of 100 nations.

21. NIKE

Nike logo

Sector: Purchaser Discretionary

Industry: Apparel, Accessories and Luxury Goods

Market Cap.: $ 154.9 Billion

Stock Symbol: NKE

Site: nike.com

Nike, Inc. is a world-driving worldwide enterprise assembling and providing athletic shoes, activewear, and gear.

Nike is engaged with the plan, improvement, assembling, showcasing, and deals of footwear, attire, gear, adornments, and associated services.

Nike is engaged with the plan, improvement, assembling, showcasing, and deals of footwear, attire, gear, adornments, and associated services.

22. IBM

IBM logo

Sector: Data Technology

Industry: IT Consulting & Other Services

Market Cap.: $ 136.2 Billion

Stock Symbol: IBM

Site: ibm.com

Founded in 1911, the International Business Machines Corporation, better known as IBM, is a multinational information technology company operating in more than 170 countries.

Assembling and advertising PC equipment, middleware and programming and giving facilitating and counselling administrations, IBM is likewise a significant innovation research association.

23. United Technologies

United Technologies logo

Sector: Industrials

Industry: Aerospace and Defense

Market Cap.: $ 135.9 Billion

Stock Symbol: UTX

Site: utc.com

United Technologies Corporation, UTC, is associated with the exploration, advancement, and assembling of aeroplane motors, aviation frameworks, HVAC, lifts and elevators, fire and security, building frameworks and modern items. It is additionally an enormous military temporary worker.

24. American Express

American Express logo

Sector: Financials

Industry: Consumer Finance

Market Cap.: $ 106.8 Billion

Stock Symbol: AXP

Site: americanexpress.com

The American Express Company, otherwise called Amex, was established in 1850.

Initially associated with cargo sending, American Express has later occupied with movement benefits and become a pioneer in cards and instalments innovation before growing further to imaginative computerized items and administrations.

25. 3M

3M logo

Sector: Modern

Industry: Industrial Conglomerates

Market Cap.: $ 92.1 Billion

Stock Symbol: MMM

Site: 3m.com

3M Company is an expanded mechanical and innovation organization working through a wide scope of areas:

- Car,

- Business arrangements,

- Interchanges,

- Customer,

- Plan and Development,

- Gadgets,

- Energy,

- Medical services,

- Producing,

- Mining, oil and gas,

- Security, and

- Transportation.

26. Goldman Sachs

Goldman Sachs logo

Sector: Financials

Industry: Investment Banking and Brokerage

Market Cap.: $ 84.3 Billion

Stock Symbol: GS

Site: goldmansachs.com

Established in 1869, the Goldman Sachs Group, Inc., is one of the world's biggest multinational investment bank settled in New York City.

It is additionally occupied with monetary administrations including speculation the board, protections, resource the executives, prime business, and protections guaranteeing.

Goldman Sachs is an essential vendor in the United States Treasury security market and all the more by and large, a noticeable market producer.

27. Caterpillar

Caterpillar logo

Sector: Industrials

Industry: Construction Machinery & Heavy Trucks

Market Cap.: $ 73.7 Billion

Stock Symbol: CAT

Site: caterpillar.com

Trucks Caterpillar is a world-leading producer of development and mining hardware, diesel and flammable gas motors, modern gas turbines, and diesel-electric locomotives.

It works through its primary Cat, Cat Financial, Cat Reman and Cat rental store mark just as numerous other particular brands.

28. Walgreens Boots Alliance

Walgreens Boots Alliance logo

Sector: Buyer Staples

Industry: Drug Retail

Market Cap.: $ 47.2 Billion

Stock Symbol: WBA

Website: walgreensbootsalliance.com

Walgreens Boots Alliance, Inc. is a holding organization that claims Walgreens, Boots, and various drug assembling, discount, and dissemination organizations.

It works in 25 nations through three divisions: retail drug store USA (Walgreens), retail drug store worldwide (Boots and other retail tasks globally), and drug discount (Alliance Healthcare).

29. Dow

Dow logo

Sector: Materials

Industry: Commodity Chemicals Dow Inc.,

Market Cap.: $ 35.3 Billion

Stock Symbol: DWDP

Site: dow.com

Market Cap.: $ 35.3 Billion

Stock Symbol: DWDP

Site: dow.com

Is the parent organization of The Dow Chemical Company, a world-driving compound organization occupied with the creation of plastics, synthetics and rural items.

It principally offers its items to different enterprises instead of end-shoppers.

30. Travelers

Travelers logo

Sector: Financials

Industry: Property and Casualty Insurance

Market Cap.: $ 34.8 Billion

Stock Symbol: TRV

Site: travelers.com

The Travelers Companies, Inc., otherwise called Voyagers is a protection agency especially engaged with business property-setback protection.

Probably the biggest back up plan in the US, Travelers works in close to home protection, business protection, and bonds.

It It has extended in the United Kingdom, Ireland, Singapore, China, Canada, and Brazil.

It It has extended in the United Kingdom, Ireland, Singapore, China, Canada, and Brazil.

Assessment

Issues with market portrayal

With the incorporation of just 30 stocks, pundits, for example, Ric Edelman contends that the DJIA is an off base portrayal of generally market execution contrasted with more extensive files, for example, the S&P 500 Index or the Russell 3000 Index.

DJI Top 30 Components

Additionally, the DJIA is censured for being a cost weighted file, which gives more expensive stocks more impact over the normal than their lower-evaluated partners yet fails to assess the overall business size or market capitalization of the segments.

DJI Top 30 Components

Additionally, the DJIA is censured for being a cost weighted file, which gives more expensive stocks more impact over the normal than their lower-evaluated partners yet fails to assess the overall business size or market capitalization of the segments.

For instance, a $1 increment in a lower-estimated stock can be refuted by a $1 decline in a lot more extravagant stock, in spite of the way that the lower-valued stock encountered a bigger rate change.

Moreover, a $1 move in the littlest segment of the DJIA has a similar impact as a $1 move in the biggest part of the normal.

For instance, during September-October 2008, previous part AIG's opposite split-balanced stock cost crumbled from $22.76 on September 8 to $1.35 on October 27; adding to an around 3,000-point drop in the list.

As of March 2020, Apple and UnitedHealth Group are among the most expensive stocks in the average and accordingly have the best impact on it.

On the other hand, Pfizer and Dow Inc. are among the most reduced estimated stocks in the average and have minimal measure of influence in the value development.

On the other hand, Pfizer and Dow Inc. are among the most reduced estimated stocks in the average and have minimal measure of influence in the value development.

Pundits of the DJIA and most protections experts suggest the market-capitalization-weighted S&P 500 Index or the Wilshire 5000, the last of which incorporates most freely recorded U.S. stocks, as better markers of the U.S. financial exchange.

The Relationship Among Segments

An investigation between the connection of parts of the Dow Jones Industrial Average contrasted and the development of the record finds that the connection is higher when the stocks are declining.

The relationship is least in when the normal is level or rises a humble sum.

The relationship is least in when the normal is level or rises a humble sum.

Youtube Video of DIJ Historical Data starting from 1985 to Nov 2019.

15+ Some other Important QnA's of Yahoo Finance DJI or DJIA

1. I am trying to retrieve market data from Yahoo! finance and the script has worked fine for years, but recently, it stopped showing The Dow Jones data.

"If you can't download information for the Dow Jones Industrial Average, it is on the grounds that Yahoo! is not, at this point authorized to give information downloads to the Dow Jones Index.

Right now, Dow Jones Industrial Average [^DJI] information must be seen on the screen. It can never again be downloaded."

2. ^DJI quote data does not download to Excel for past 2 days?

The constraint you are experiencing is because of limitations by the Dow Jones Index. Yahoo! is not, at this point ready to give Dow Jones Index information as such.

3. Is djia accurate?

With the current incorporation of just 30 stocks, pundits, for example, Ric Edelman contends that the DJIA is definitely not a precise portrayal of generally speaking business sector execution.

In any case, it is the most referred to and most generally perceived of the securities exchange records.

4. When did the dow jones mechanical normal start?

Initial components.

Dow determined his first normal absolutely of mechanical stocks on May 26, 1896, making what is currently known as the Dow Jones Industrial Average.

None of the first 12 industrials still remain part of the list.

5. What is Dow Jones average?

The Dow Jones Industrial Average is a cost weighted normal of 30 blue-chip stocks that are commonly the pioneers in their industry.

6. How the Dow Is Weighted?

The DJIA is price-weighted. Instead of utilizing a straightforward number-crunching normal and isolating by the quantity of stocks in the normal, the Dow Divisor is utilized.

This divisor smooths out the impacts of stock parts and profits.

The DJIA, consequently, is influenced uniquely by changes in the stock costs, so organizations with a higher share cost or a more extraordinary value development greatly affects the Dow.

7. Is a company included in the Dow Jones mechanical average?

The consideration of an organization in the Dow Jones Industrial Average doesn't rely upon characterized measures. Rather, a free Wall Street Journal commission chooses whether an offer is to be incorporated or barred.

8. What is the Dow Jones Industrial Average?

The Dow Jones Industrial Average is a cost weighted normal of 30 enormous American traded on open market organizations on the securities exchange.

"The Dow," as it is regularly called, is included huge stocks like Apple and Disney, and its stocks are exchanged on the NYSE and the Nasdaq.

"The Dow," as it is regularly called, is included huge stocks like Apple and Disney, and its stocks are exchanged on the NYSE and the Nasdaq.

The Dow was made by Charles Dow in 1896 as an assessor of the overall market.

9. What companies are under Dow Jones?

Regularly alluded to as "the Dow," the DJIA is one of the most-watched stock lists on the planet, containing organizations like Microsoft, Coca-Cola, and Exxon.

10. What is the abbreviation for Dow Jones?

To follow the development of the American monetary business sectors and economy, the supplies of 30 enormous traded on open market organizations recorded on the NYSE or the NASDAQ are accumulated to shape the Dow Jones Industrial Average list - abridged DJIA - and for the most part, alluded to as the Dow Jones, or more simply the Dow.

11. Is Dow Jones index publicly traded?

Here, thirty of the biggest traded on open market organizations that structure the Dow Jones file are given together their exercises, logos, and valuable connections.

In the US, enormous organizations are consolidated to get freely recorded on a stock trade.

12. What companies are owned by the Dow?

Frequently alluded to as "the Dow," the DJIA is one of the most-watched stock lists on the planet, containing organizations like Microsoft, Coca-Cola, and Exxon.

Dow Jones (the organization) possesses the Dow Jones Industrial Average, just as numerous different lists that speak to various parts of the economy.

13. Is the Dow the same as the DJIA?

The Dow "The Dow" as a matter of fact alludes to the Dow Jones Industrial Average (DJIA), a significant list that numerous individuals watch to get a sign of how well the general securities exchange is performing.

The Dow, or the DJIA, is not the same as Dow Jones and Company, the a firm that is possessed by News Corp. and distributes the Wall Street Journal.

14. What companies are in the Dow Jones mechanical average?

It is anything but difficult to mistake Dow Jones for the Dow Jones Industrial Average (DJIA).

Frequently alluded to as "the Dow," the DJIA is one of the most-watched stock records on the planet, containing organizations like Microsoft, Coca-Cola, and Exxon.

15. What is DJIA in stock market?

Today, the DJIA is a benchmark that tracks American stocks that are viewed as the heads of the economy and are on the Nasdaq and NYSE.

The DJIA covers 30 huge top organizations, which are abstractly picked by the editors of The Wall Street Journal.

The DJIA covers 30 huge top organizations, which are abstractly picked by the editors of The Wall Street Journal.

16. What is the historical backdrop of the DJIA?

Key Historical Dates for the DJIA.

The following are a portion of the milestones hit by the DJIA:

- March, 15, 1933: The biggest one-day rate gain in the record occurred during the 1930s bear market, totalling 15.34 per cent.

The Dow increased 8.26 focuses and shut down at 62.10.

17. How To Be Listed on Dow Jones Industrial Average?

The Dow Jones Industrial normal is setting out toward an unavoidable change with the normal chapter 11 documenting of auto goliath General Motors.

With With the run-in of the once-amazing blue-chip stock, a significant number of my customers have asked to how organizations get recorded on the Dow Jones Industrial Average and when are they supplanted.

I figured I would give a concise foundation on the starting point of the Dow Jones, with the current holdings as well as what it takes to be listed.

18. List of the Major Stock Indexes

19. How can we View and Compare of DJI, GSPC, GSPTSE, IXIC on Yahoo Finance?

NYU's Galloway on why the Dow is 'One of the Most Dangerous Numbers Ever Manufactured'

All Points covered in this video given below:

- Yahoo finance inx,

- Nasdaq yahoo finance,

- Dow jones,

- Dow jones yahoo chart,

- Google finance,

- Yahoo finance charts,

- Dow futures,

- S&P 500 yahoo finance,

- DJIA stock market today yahoo,

- DJIA yahoo finance chart,

- Yahoo finance download historical data,

- DJIA yahoo news,

- DJI yahoo charts,

- Yahoo finance dow jones historical,

- Dow finance,

- Dow jones live ticker streaming.