Question: Presently I am 25 years of age, following 30 years my fundamental objective is to gather the greatest sum. What do I do to accomplish that objective?

I will attempt to disclose the response to this inquiry by different cinereous, which are as per the following:

1. On the off chance that you need to contribute a single amount of Rs. Assume you have 20 lakh rupees all the more then you can do Taste. Also, you 40,000 ppm for the following 30-year time frame.

In the event that you comprehend the unpredictability related with value venture, at that point, you can contribute Rs. 20 lakhs as a value which is right now singular amount or uses STP strategy to put resources into value more than 5 years (around Rs. 4 lakhs will be put resources into value every year).The choice of Lumpsum now or through STP ought to be simply remembering your comprehension of the value markets.Aside from this present, Taste's can likewise be put resources into value plans, given that you are as of now 25 years of age and need to put away this cash for a time of 30 years to come.I am not proposing you a particular arrangement at this moment, however, urge you to distinguish the technique you wish to receive first and afterwards get the names of the particular arrangement.

2. Make an essential outline of long haul and transient objectives before any venture.

You can't focus your whole sum for such a significant stretch. I trust you should leave or guard 10% of your sum in EPF, at that point the following 10% in government securities or shared assets and 30% in FD, which ought to be for the following 3-5 years.Unwind the 20% of the family's very own costs, for example, clinical, instruction and so on and you ought to put the staying 30% in your value as referenced in the primary point.

3. Put your cash in a fluid reserve first. At that point choose your advantage assignment dependent on your danger affectability.

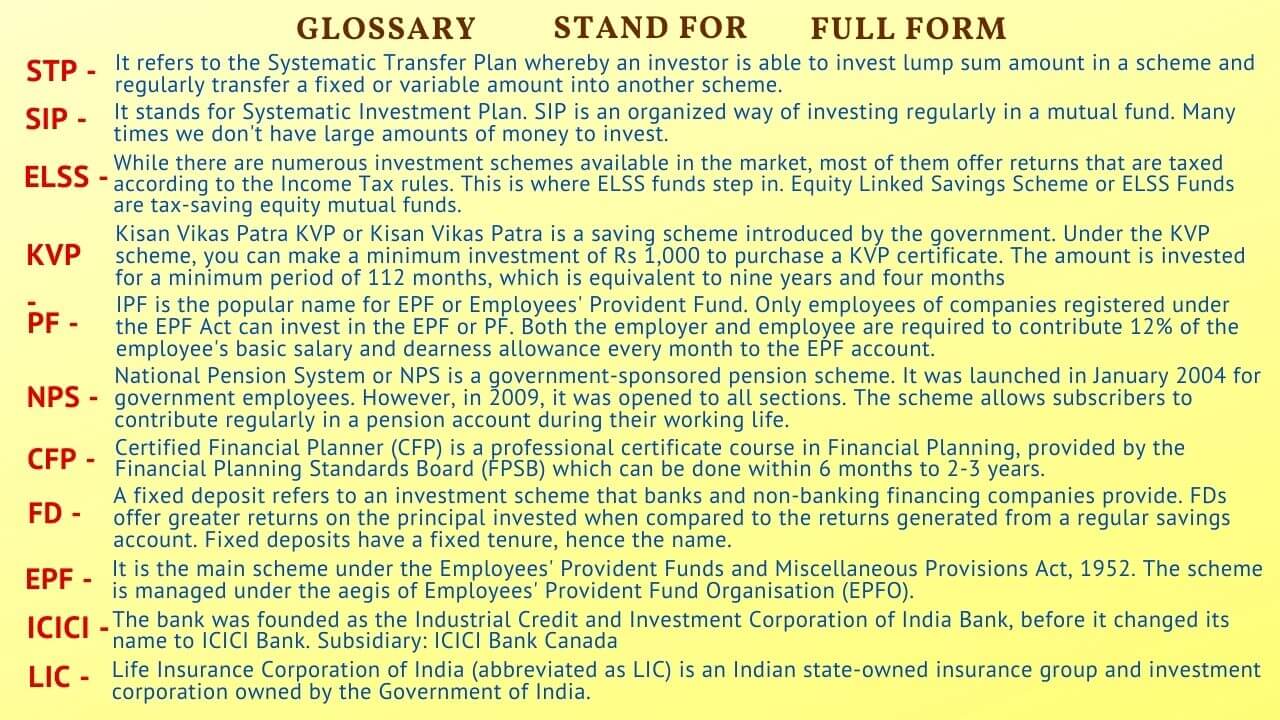

The different resource classes accessible are value, shared assets, gold, land, fixed stores, sovereign gold bonds, ELSS, KVP, PF, NPS, mailing station stores with changing measures of danger and returns.You can consider building an arrangement of offers through sites, for example, Market Magic, through free exploration or reaching a budgetary organizer (ideally one who is a CFP).You are mentioned to make a fair resource assignment according to old convictions "Don't tie up your assets in one place". This will be the most ideal choice for you.

4. In the current financial situation, where the value market is unpredictable and loan costs are descending, it is better for you to go for assurance and return after a predefined period.

You can purchase Jeevan Umang Extra security Strategy from LIC of India. This approach gives you the advantage of sparing and assurance of annuity forever,For the confirmation of Rs.The premium for the primary year is Rs 20482 every month, the premium for the subsequent year is Rs 20041.00 every month. For a time of 25 years.After the finish of 25 years, you will get Rs 60 lakh, and a lifetime ensured annuity of Rs 40000.In the event of death at 40 years old, the candidate got Rs. 44316000 (approx.). The arrangement gives a day to day existence hazard inclusion of Rs.For twofold mishap advantage and incapacity advantage 60 lakh in addition to inbuilt advantage, you will get Rs. 20 lakhs can be contributed.In LIC's Jeevan Shanti Strategy you can place 10 lakhs or more for the sake of your dad or mom for a time of 5 years.Expecting the age of your folks to be almost 50, you should pay Rs. An annuity will be up to 78400 every year. After your folks' way of life, you will get back your assets alongside the aggregate guaranteed.I have determined for half of the assets offered by you as you should save the equalization for putting resources into other momentary protections.Sovereign Gold Bond is another plan which has gotten appealing in the current situation, for this you can go to any close by Jeevan Bima office and get more data.

5. Here I would recommend you go from fluid store to STP mode to adjusted reserve and on the off chance that you comprehend that the unpredictability of the market blast isn't fitting right now.

At that point, you can put resources into ICICI multi-resource finance which is giving over 8%. You will have a pleasant face next time you see me.

Finally, in the event that you have an enormous sum accessible to contribute, I accept that you can likewise consider taking point by point exhortation from expert money related organizer by and by. Personal Investment Planning India.

Furthermore, after that, you are allowed to contribute to anyplace.

Glossary