To answer this question, we must first log in to the simulator. But here we will not talk about how to login in it today. Rather, we will understand it in a sequential manner through the questions given below.

First of all, we have to understand:

- What is Investopedia?

- What is Investopedia Stock Test System?

- How Would You Utilize Stock Test systems?

- How the Market Functions?

- Investopedia Stock Simulator?

- How does that work?

- Does the simulator have any rules?

- How Do You Use Stock Simulators?

(Simulator - test system)

So let's get started...

What Is Investopedia?

The site fills in as an asset for speculators, purchasers, budgetary experts, and understudies who look for direction or data on different themes.

The site distributes articles on ventures, protection, retirement, bequest and school arranging, shopper obligation, and a combination of other instructive material.

Realities of Investopedia-It has helped a huge number of individuals get accounts, contributing, and cash the executives since 1999.

What is Investopedia Stock Test System

One of the major online results of Investopedia is its stock test system.

The program gives clients $100,000 in virtual cash to buy stocks, protections and different interests continuously situations.

The test system gives potential merchants a sample of what it resembles to attempt to bring in cash on ventures before spending real cash on the securities exchange.

The game permits fans to challenge each other to see who performs better after some time.

This part of Investopedia requires enrollment through an email address or Facebook.

Key Realities

- Investopedia was established in 1999 by Cory Janssen and Cory Wagner, two alumni of the College of Alberta in Canada.

- The site fills in as an asset for speculators, shoppers, experts and understudies who look for direction or data on different monetary and venture related themes.

- Despite the fact that Investopedia began as a hotspot for monetary terms, it has extended to bring ideal stock examination and budgetary news to clients.

- Investopedia's stock test system is one of the webpage's greatest online items, offering clients $100,000 in virtual cash to work on exchanging.

How Would You Utilize Stock Test systems?

Have you considered purchasing stock in a specific organization yet simply didn't have the money to make an exchange?

Or then again maybe you heard the news about an organization and pondered internally that the stock cost was ready to rise?

Or then again perhaps have you have in every case simply needed to find out about picking stocks?

On account of virtual stock trade innovation, financial exchange test systems that let you pick protections, make exchanges and track the venture results — all without gambling a penny — are as close as your cell phone or console.

How the Market Functions?

How the Market Functions is promoted as:

The web's most mainstream free financial exchange game.

Like the vast majority of the test systems, to join, you enter your email address and age, select in or out of outsider contact, pick how much virtual money you'd prefer to begin with, and afterwards you're prepared to exchange.

- On this site, speculators can purchase stocks, shared assets and trade exchanged assets (ETFs) in the U.S. furthermore, Canadian business sectors.

- Cash exchanging and short-selling empowers financial specialists to rehearse further developed contributing techniques.

- The penny stock zone even gives nitty-gritty knowledge into the potential risks speculators face when exchanging penny stocks.

You can now likewise work on exchanging worldwide stocks, alternatives, and fates, from trades in Toronto, London, India, Mexico, Tokyo, Hong Kong, Australia and more global business sectors.

A few exchanging modes are accessible, giving everything from ongoing hours that coordinate the financial exchange (counting broadened hours exchanging for those looking to reproduce the live-market understanding) to a fun mode that licenses exchanging 24 hours per day.

How the Market Functions gives a broad library of instructive articles to enable new speculators to begin and an assortment of challenges that pit would-be dealers against one another in a trial of virtual exchanging abilities.

To encourage different exchanging systems, it likewise gives information on the most-effectively exchanged stocks, and an outline of the bearing the money related business sectors are moving in.

For financial specialists who are prepared to burrow somewhat more profound and start exploring singular protections, the site's exploration territory gives a similar degree of detail accessible in genuine money market funds, including organization news and expert suggestions.

While the site has a critical number of alluring highlights, more modern speculators may not value the restricted determination of request types.

Market orders, limit requests and following stops are the accessible exchanging determinations.

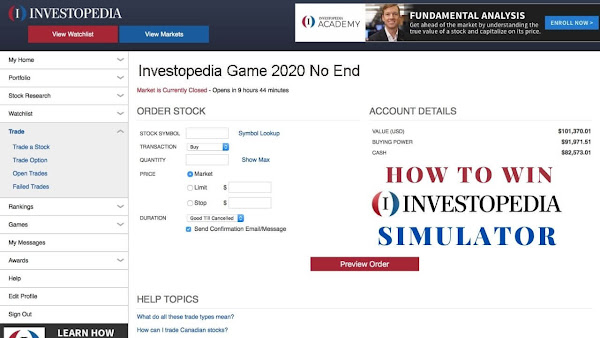

Investopedia's Stock Simulator?

The Investopedia Stock Simulator is very much incorporated with the budgetary instruction, the site's recognizable substance and starts off speculators with a virtual equalization of 100,000 dollars for exchanging.

The test system incorporates a progression of "how-to guides" on themes, for example, buying stocks, progressed exchange types, and covering short positions.

The genuine exchanging happens with regards to a game, which can include joining a current game or making a custom game that permits the client to arrange the guidelines.

Sorts of games incorporate U.S. stocks, Canadian stocks, those focused on learners, those intended for further developed speculators and self-planned meetings that let you practice an exceptionally set of aptitudes.

Alternatives, edge exchanging, movable commission rates and different decisions give an assortment of approaches to redo the games.

From that point, players can survey property, exchange and check their rankings, research ventures and audit their honours (which can be earned for finishing different exercises).

Empower Your Abilities With Recreated Exchanging:

- Figure you can beat the Road?

- Have you perceived an association you essentially realize will encounter the housetop?

- Got a hunch about a hot first offer of stock?

Before you bet the farm, have a go at testing your speculations without taking a risk with your merited money.

Welcome to the universe of protections trade test frameworks.

Practice Your Aptitudes

Money related trade test frameworks are online gadgets that license examiners to practice their stock-picking capacities without taking care of real money.

Money related experts sign-on, set up a precedent, and get a set proportion of reproduced money with which to make impersonated hypotheses.

Highlighted conversations

For beginning theorists, stock test frameworks are a remarkable strategy to make contributing capacities.

Experienced theorists use test frameworks to evaluate trading techniques before endeavouring them this current reality.

Endeavour a protections trade proliferation competition to test your aptitudes against veritable foes with fake money.

Too as can be relied upon to help esteem trades, choices trades, limit and stop demands, and short selling. Like online speculation reserves, they adjust for most corporate exercises, for instance, parts, benefits, and mergers.

To lay it out simply, a monetary master can test basically any trading method without danger.

Student Advantages

For fledgeling examiners, using a test framework is a phenomenal strategy to get some answers concerning contributing.

They can get some answers concerning basic theory thoughts, gotten acquainted with examining stock tables, get a sentiment of the impact of market flimsiness, test trading philosophies, and considerably more.

News features give information into authentic events, for instance, corporate humiliations, salary news, and the effects that refresh or scales back gave by Money Road specialists have on stock expenses.

They're in like manner a mind-blowing preamble to budgetary expert examination. Test frameworks overall offer an enormous gathering of gadgets, including true costs, execution diagrams, esteem benefit extents for unequivocal securities, and chronicled trading data for various endeavours and records.

Ace Speculators Observe

Monetary trade test frameworks can be noteworthy instruments regardless, for experienced examiners. They use them for the opportunity to test-drive complex trading philosophies and ensured circumstance.

Following the results of a reproduced trading procedure after some time empowers the theorist to refine aptitudes before testing them in actuality.

Investigation instruments engage examiners to screen Initial public offerings, track trading volumes, and production altered screens reliant on particular and key guidelines.

Tap Into Genuine Assets

As strong as they can be, test frameworks are just a single gadget for the theorist. There's no clarification not to use others.

Check out tips from your vendor, scrutinized flyers created by stock-picking experts, and follow the money related news. Everything grain for your imitated adventure portfolio.

Those various resources are more grain for the test framework.

Test frameworks can even give you something yourself. Your reactions to the advancements of your replicated portfolio give you a sentiment of how you will react to equivalent improvements in an authentic portfolio.

Addition From Others

Some online objections run protections trade diversion competitions that offer players an opportunity to win authentic money.

These contentions can be an exceptional technique to set your frameworks and aptitudes contrary to those of various monetary authorities.

A horrendous decision in reproduced trading is more straightforward to get over than a genuine mistake in all actuality.

Whether or not you don't find your name at the top of the pioneer board close to the completion of the restriction, you'll regardless of everything have the alternative to watch and addition from the triumphant strategy.

The Constraints of Reproduction

There is no vulnerability that test frameworks are worthy contraptions, notwithstanding, even the best of them can't totally reproduce the real deal.

They offer fewer securities and more restricted trading limits than the certified overall budgetary business areas.

A test framework may not allow trading new stocks or penny stocks.

There may be a period delay in the data deals with, which infers your trade won't be executed in a brief instant, as, in fact.

Investopedia's Test system, which is free, has a 15-minute time delay.

Best of all stumbles made in reenacted trading are successfully disregarded.

You'll never mourn losing $10,000 in envision money with a trade a high-peril biotech stock.

Explanation of Exchanging Rules

We will probably address authentic trading as eagerly as could be normal in light of the current situation.

Anyway, because we aren't generally drawn in with the market (and thusly aren't affecting it), there are a couple of restrictions that don't exist in a real trading account.

Grant Late Passage - This setting coordinates when customers are allowed to join a game. Not allowing late section will shield new customers from joining the game after the game has quite recently started.

License Portfolio History Survey - This setting chooses if customers in a game are allowed to see each other's trade history by methods for the rankings page.

Grant Portfolio Review - This setting chooses if customers in a game are allowed to see each other's portfolio by methods for the rankings page.

Grant Portfolio Resetting - This setting chooses if customers have the ability to reset their portfolios back to their beginning state.

Consistently Volume Rule - Exchanges can't outperform a particular degree of volume for the day. The default regard is 10% and this applies to the two stocks and decisions.

This thwarts a gently traded stock from being traded the test framework when it can't be traded the certified business divisions.

Quick Sell Rule - You can't sell security inside a particular time span to reflect how we are functioning with conceded data.

The default regard is 15 minutes. This is our strategy for ensuring that customers don't "cheat" by trading and out of a stock using steady data.

Least Value Rule - Just securities over $1 are allowed to be traded long, and only assurances over $5 are allowed to be traded short.

Penny stocks are more disposed to control from stock publicists and can have capricious trading plans. It's in this manner that we don't allow them in our default contention.

Edge requirements in numerous countries are additionally requesting when shorting stocks underneath $5.

We avoid this bother by not allowing stocks under $5 to be shorted in any way shape or form.

Development Rule - The best proportion of one stock that you can buy is equal to half of your starting cash.

A particular decisions contract is confined to 10% of your starting cash.

For example, in case you start with $100,000, you can simply purchase up to $50,000 in any single stock. We do this to make the game more sensible.

In spite of the way that some may fight that they have to put their entire portfolio in one security, this is more like wagering than contributing.

Market Postponement - On the grounds that we use a 20 second conceded Datafeed, it is imperative to hold market orders for a particular time before being filled. We unequivocally endorse this be set to 20.

If it isn't, there is a high probability that a couple of solicitations may get stale proclamations.

Elective Everyday Volume - Exchanges can't outperform a particular degree of volume for the day. The default regard is 10% for choices, in any case, this can be changed in custom competitions.

This prevents a gently traded decision from being traded the test framework when it can't be traded the authentic business segments.

Least Value Short - Just assurances over $5 are allowed to be traded short. Penny stocks are more disposed to control from stock publicists and can have unconventional trading plans.

It's thusly that we don't allow them in our default contention. Edge essentials in numerous countries are additionally requesting when shorting stocks underneath $5.

We keep up a vital good ways from this unpredictability by not allowing stocks under $5 to be shorted using any and all means.

Least Stock for Edge - The base dollar entirety that allows security to be peripheral.

Edge Intrigue - The value addresses the financing cost your record will be charged if you use edge to purchase assurances.

Cash Premium - This value addresses the advance expense the cash balance in your record will pick up. Premium is earned on the ordinary cash balance, in any case, it is paid to your record reliably.

You can see interest portions in the Exchange History section of your record.

Commission Market - The commission charged for each market trade. The default commission setting is $19.99.

Commission Breaking point - The commission charged for every cutoff trades. The default commission setting is $29.95.

Commission Alternative - The base commission for decisions. Elective trade commissions contain this impetus notwithstanding the entirety per contract times the quantity of arrangements. The default commission setting is $19.99.

Commission Per Agreement - The per contract commission for options. Decision trade commissions contain the base total notwithstanding this entirety times the number of arrangements. The default commission setting is $1.75 per contract.

You should connect with us if you have gone over some other goof messages that you don't grasp.

Other Way to understand How to win Investopedia Simulator

Step by step instructions to win Investopedia test system or (Simulator)

Be Forceful

Winning Investopedia Test system, where the game has a brief span and there are no exchanging standards (the game doesn't determine the sort of stocks qualified to be exchanged), requires completely unexpected strategies in comparison to you would use with your own cash.

They expect you to be Exceptionally Forceful!!! You should face challenges and put resources into stocks that you Ought to dodge in your own portfolios on account of the high danger factor.

Follow The Market

The most significant advance is to distinguish the course of the market. This progression is just essential in the event that you have just one record to exchange.

On the off chance that you have at least two, at that point, you can cover your wagers by going LONG in one record and SHORT in the other.

In any case, on the off chance that you just have one record, you should ensure you are on the correct side of the market.

For an amateur broker, the most straightforward approach to decide the market's bearing is to take a gander at one of the Market Pointers.

They are on the whole moderately hard to comprehend for an amateur yet that is alright. You don't have to comprehend them to utilize them. All you need is to discover a site that will decipher the market heading.

For instance, in the event that you take a gander at the S&P 500 Bullish Percent File diagram and hope to check whether the graph is indicating green (Positively trending Business sector).

In the event that the market pointers befuddle you, you can take a gander at a diagram of a market file. The entirety of the most famous are recorded at http://stockcharts.com/.

The most famous record is the Dow Jones Modern Normal graph. Take a gander at the heading of the graph (up or down) and decide whether you are a BULL or a BEAR.

When you choose the bearing of the market, you should distinguish which stocks have the most potential to move toward that path the quickest – as you are feeling the squeeze from the game. The remainder of the article will assist you with distinguishing these stocks.

Top Stock Picks To Beat The Market

To get the stock picks that beat the market, buy into the best stock picking administration.

Use Utilized ETFs as they Give Quick Returns

Utilized ETFs are known as a "cheat" by normal stock game players as these ETFs commonly give far quicker returns.

ETFs are Trade Exchanged Supports that demonstration like Common Assets yet exchange like stocks. Utilized ETFs utilize budgetary subordinates (an advanced method for exchanging) and obligation (like bonds) to intensify the profits of an assortment of files.

By and by, it isn't essential to comprehend Utilized ETFs, yet they will give far quicker returns than customary stocks, securities, ETFs or Shared Assets.

Since you have just picked your best supposition at the heading of the market, picking a Bull ETF (market going up) or Bear ETF (market going down) will be simple.

Utilized ETFs come in a few products of a record including 2X and 3X ETFs.

A 2X will attempt to twofold the profit for its predetermined record and a 3X will attempt to significantly increase its file. Obviously, you will need to utilize 3X ETFs.

NOTE TO Teachers

It is unmistakably more instructional to indicate that the understudies just use "stocks" in their portfolios and that the stocks must have an incentive over $10 to maintain a strategic distance from the issue with Penny Stock exchanging.

Truly, an understudy can accomplish unquestionably more return in the hazardous universe of utilized ETFs however it will show them minimal true financial exchange exchanging.

Glossary

Market Pointers:

Specialized pointers that are utilized by merchants to anticipate the bearing of the major money related records. The most known are the Development/Decrease List, Outright Broadness File, Arms List and McClellan Oscillator.Utilized ETFs:

A trade exchanged store (ETF) that uses monetary items and monies due to amplify the profits of a basic file. Utilized ETFs are available for practically all files, similar to the Nasdaq-100 just as the Dow Jones Mechanical Normal.Market File:

By collecting the estimation of a related gathering of stocks or other venture vehicles together and communicating their complete qualities against a base an incentive from a particular date.Market files help to speak to a whole securities exchange and in this manner give financial specialists an approach to screen the market's progressions after some time.

Recollect this is a stock game.