Best Mutual Fund To Invest in 2020 India

Hello friends, when I tell you that you should invest in ABC mutual funds. Because this mutual fund has given good returns in the past and will also give good returns in future.

When you listen to me, you invest in that particular stock without doing any research and without taking any decision.

Then have you made a good decision or a bad decision because here you have made a big mistake.

So, friends, these people will tell you that this mutual fund is really very good, and you invest in it, so that you can get good returns and when you do not get good returns, it bothers you.

But you will rarely find such people who will tell you how you can choose a good mutual fund for yourself.

If you can decide for yourself which mutual fund is good, then you can choose a good mutual fund for yourself.

Then you can make a good investment decision, which will give you a good return in future.

I am your friend investment buddy, welcome to today's post, let's start today's post,

5 Ways to find a right Mutual Funds:

In this post, we will talk about 5 ways that will help us find the right mutual fund that can give us good returns in future.

Read this post till the end so that you understand what you should keep in mind while choosing to invest in a mutual fund.

You can choose a good mutual fund.

Before starting the post, we would like to request all of you that if you have not yet shared this post with your friends, please share it and make a bookmark.

As this post, we keep posting 4 to 5 every week for educational purposes. Which can help you become an intelligent investor, and explain other forms of finance and investment?

Now let's begin this post today.

Friends, many people make the mistake with mutual funds that they choose a mutual fund only by looking at its performance.

Seeing its return, but they do not think about what was their purpose in investing in mutual funds and what purpose do they want to achieve?

Before coming to this, I would like to give you an example. When you go out of your house with your vehicle, you know what is the reason for your destination.

And unless you know your destination then you cannot make a good decision and will not be able to choose the right path and whenever someone The journey is not good if one leaves his home without knowing his destination and starts his journey.

Friends, the same thing happens in the case of mutual funds.

1. Goals and Objectives:

Whenever you think of investing in mutual funds, you should have a goal and a purpose.What you thought about investing in mutual funds that you want to get.

The near future and that goal can be anything that can vary from your children's education to buying a home to buy a vehicle.

Any such purpose where you need money or the money you have just left, in the coming time, that money should increase from the present standard of 10% to 15%.

After that, your purpose and goals are defined after which you should think about investing and after which your journey starts in mutual fund investing.

After this, you should start thinking about how to choose a good mutual fund.

Once you decide on your desired goal, suppose that you want to buy a vehicle but before you can achieve that goal, you should know how much time you have to get that goal.

Now let's say I want to buy a house. But I know that I have to buy my house in 5 years.

After which I would know that if that house comes to 50 lakhs, then according to that, how much investment will I have to start now.

And how to do that investment is also linked with your goal. Linked with your income, linked with your risk profile.

How does it work?

If I use the same example here, let's say you want to buy a house, after 5 years you need 50 lakh rupees.

If I talk on your risk profile as of today, if you are a trader you have a lot of cash.

If you want to make a one-time investment, you have to invest all your money in a mutual fund, it is called a one-time investment.

Friends, if you are a salaried employee, and you get money monthly, then in that case, how would you invest?

2. Systematic Investment Plan (SIP)

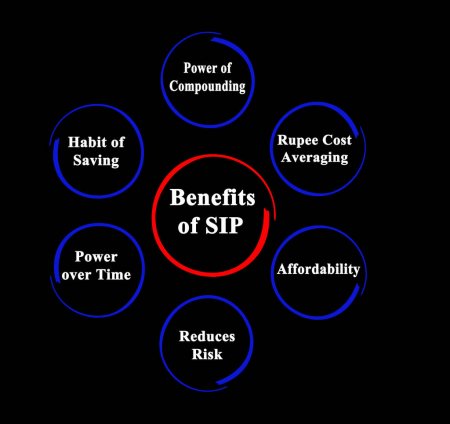

In that case, you should go for SIP as your investment option in mutual funds and SIP has many benefits.

For example, if you invest money every month and if the market is very stable then you get the benefit of volatility and average price.

When the market goes up, you invest more and when the market goes down, you invest less.

The most important step is that you have to define your goal, along with the goal also define how much period you have to invest.

And along with the duration, you also have to define how to invest, whether you go for one-time or SIP.

Risk:

So, friends, let's talk about the second important parameter known as risk.Many people talk about it, understand it but do not know how to apply it in their investment decision.

In every post, we have explained that it is very important to adopt risk profiling.

Friends, your income may be unstable or stable. You may have a lot of reserves. Everyone has a different income scenario. Because the income scenario is different, each person has a different risk appetite.

If you are thinking of investing in mutual funds, then you must know your risk-taking ability. That you have to take more risk or take less risk.

Because according to your risk-taking ability, you should choose your mutual fund.

If you have a high-risk appetite, due to high risk, you can expect higher returns, which is why you may prefer to invest in equity mutual funds.

Equity Mutual Funds = More Risk and More Return

But there are people who do not want to take the risk at all, then debt funds are better for them.

Debt Fund = Less Risk

3. Competition with Peers:

Now suppose you have defined your risk and your goal, assuming you want to buy a house after 5 years, then your risk appetite is high, so you may have to take a little more risk.That is why you have chosen large-cap investment. Now you will have more than 50-60 options here, through which you can invest in large-cap investments.

How to choose a good mutual fund?

Now here it becomes most important that you should look at the performance of the last 5 to 7 years so that you can get an idea of how the mutual fund has performed before and after that.

Now the most important point is that a large-cap mutual fund gave a return of 15% and a small-cap mutual fund gave a return of 25%.

Now people who make mistakes here think that 25% mutual fund has given more returns, so I invest here. Because it has performed better, so I should invest here.

No, friends, you have chosen a large-cap mutual fund based on your risk appetite and if a large-cap mutual fund has given a return of 15%, then you need to compare that 15% return to that. With the entire category.

Mutual funds of the same category and its category will be large-cap mutual funds. The return of large-cap mutual funds should be compared to the total large-cap returns of how this large-cap performed compared to its rivals?

Performed them out or underperformed.

4. Expense and AMU:

Friends, now we talk about the fourth parameter which is related to expenditure and AUM, it is very important to understand about expenses.Whenever you invest in mutual funds, it is very important to understand the expenses as there can be many expenses, which investors are not aware of.

Expense ratio

The expense here is called the expense ratio. The expense ratio is charged because you have given your money to an asset management company that will invest in securities on your behalf.Now they may have some research costs and many other costs that will be charged to you. The expense ratio and this expense ratio may vary.

Whenever you are going to invest in a mutual fund, you should know its expense ratio because friends, if the expense ratio is high, your returns will be low and if the expense ratio is low, then your returns as an informed investor I will have more.

Therefore it is important for you to find out the ratio of the mutual fund you are going to invest in.

Exit Load

In any mutual fund, exit load is levied if you take out your loan before the pre-defined time.If you have any contingent liability in future, then you should have knowledge of exit load, then your expectations should be clear.

It should be said that if I withdraw money before the stipulated time, then my returns may be affected because the exit load will be charged.

5. Asset Under Management (AUM)

Now, we will talk about AUM (Asset Under Management) that why AUM is important for you?

If I talk about debt mutual funds, debt mutual funds are very important. That the higher the AUM within the date range of the mutual fund in which you are going to invest, it is considered as good.

Why does this happen now? Suppose, debt mutual funds invest in different debt instruments.

Now assume that the money did not come back to them from an investment and if their AUM is large, they will have no liquidity problem and if there is no liquidity problem, there will never be a scenario that mutual funds will get their operations Had to be shut down.

If I give an interesting example here you may have heard of Franklin that Franklin had to shut down his mutual fund operation because the reason for this was not the large mutual fund lending category, AUM.

When people started withdrawing money from there, a liquidity problem arose, due to which mutual funds could not return their money to their investors, which caused them to shut down their operations.

So as an investor, you should pay attention to the category you are going to invest in, in that selected category, it is considered good to have an average AUM around which you should think about investing friends.

Now we talk about how we should look at the past performance? People see the past performance in the last one year and how the mutual fund has performed in the last one year.

But here feet we would like to tell you that as past performance, you should see at least 3, 5 or 7 years. Also if you want to know the true picture.

Apart from this, one of the most important thing you should see. She should see that when you are talking about the return of the last 7 years, you should see whether the fund manager of that mutual fund has changed or not.

And if yes, you should see how the mutual fund has performed after this change, because your return depends heavily on the fund manager.

Which decides on your behalf which mutual fund you should invest in and you should never take the investment decision considering only the returns of the last one year.

Friends, if you take care of these 5,6 points and do a good analysis, you will not have to depend on anyone to tell you which mutual fund you should invest in.

Analyze yourself and choose a good mutual fund. Instead, if you are dependent on someone else, you are more likely to make a mistake.

Now if I repeat this then just define your target, decide your duration about the type of investment, do you want to choose to go for one time or SIP.

Check its returns for the last 3 to 5 years, then check the performance of the fund manager and then check your risk appetite and also choose a good mutual fund.

Keep a check on expenses so that you know how much your costs are.

If you keep these things in mind while investing, you will expect that you will be able to choose a good mutual fund and make good returns.

Friends, if you liked this post, please bookmark and share it! Comment and tell us in the coming days what topics we should cover.

If you have not yet bookmarked Yahoo Finance Buddy, bookmark it quickly.

Share this post with your friends for your financial knowledge to get more information in future so that they too can become a good investor and a good one.

Make a future as a successful investor!

0 Comments