The purpose of this post is to educate our audience on the market neutral income fund and to discuss how the fund will perform in different market environments.

So we'd like to start by giving some background and an overview of Calamus Investments for those of you who aren't as familiar with this and then discuss the investment team structure.

After that, we'll then also discuss the investment opportunity and process and then go through the product profile and then some frequently asked questions (FAQs).

Overview of Calamus Investment Firm:

- Calamus Investments was founded in 1977.

- It has just under 22 billion dollars in assets under management as of the end of the first quarter of 2018.

- They are headquartered in the Chicago metro area.

- Our offices also in New York San Francisco in London.

- Calamus Investments has 40 years of global asset management and,

- They're focused on risk-adjusted alpha.

- Importantly we have over six billion dollars of alternative strategy assets again as of March 31st 2018.

if you look at the history of our firm we have a strong tradition and alternative investing

- In 1990 they launched one of the first liquid alternative funds that were available for mutual fund investors.

- In 2012 the calamus market neutral income fund management team was nominated for US Morningstar alternative funds manager of the year.

- In 2014 we launched the calamus hedge equity income fund and,

- In 2015 we acquired Phineas Partners and launched the calamus Phineas long-short fund.

So if you look at the timeline the history of our firm we were founded in 1977 by John Callen most Senior

- Calamus Investment launched the market neutral income fund in 1990

- Calamus Investment launched the Colombo's Phineas long-short fun in 2015

- Leading to over 40 years of global asset management

Calamus Investment Team

We have an investment professional team of 70 employees and they're led by six-global CIOs that average 30 years of experience.

The team that runs the calamus market neutral income fund Is led by:

- John Callen Senior

- Eli Pars

- Jason Hill and

- David O'Donoghue

and you can go to the market neutral income fund homepage at Calamos.com for more detail on the team and their experience and CMNIX plan overview.

Investment Opportunity and Process

At this point, we'd like to discuss the investment opportunity and the process.

We think one of the things that have always been interesting about the markets has been volatility and we've always talked about the flip side of volatility being opportunity

and if we look at what's happened to the markets since 2008 a little over a decade ago we all remember what that environment was like.

The trend has really been over all these two through 2017, much higher volatility in the markets and probably more importantly much bigger swings and both upside returns and downside returns as you can see on this chart since 2008.

We've had more returns that have been higher than 4% per week both to the upside and the downside so we definitely send seen more volatility in that period.

Additionally, alternative investments have been sought by investors as perhaps a way of smoothing out the very volatile ride.

We talk about market neutral income when people ask me what I do for a living I try to break it down to two words, monetized volatility.

So, the trend and volatility in the fact that we've had these 5% or more swings in the market provide great opportunities for a product like market neutral income to seize on the volatility and monetize and we'll talk about that further in the post today.

Overview of Market Neutral Income Fund

Let me begin with a brief overview of what we're trying to achieve with the fund.

The market digital income fund we think of as an alternative fund that really is provided is there to provide absolute returns.

We utilize two complementary strategies:

- Convertible arbitrage and

- Covered call rating to achieve those objectives

So three things we're really trying to achieve

- Absolute return

- Historically lower equity beta and volatility also with limited drawdowns road to the market and

- Also providing income and capital creation appreciation while also providing preservation of capital.

We started this fund back in 1990 so it's one of the oldest liquid alternative mutual funds.

One of the things I always say is that we were liquid off before liquid also was cool and really I think we see more and more interest especially in an environment where we've been seeing very low-interest rates we've seen a pickup in volatility I think more and more investors have been looking for strategies like these.

Complementary Alternative Strategies

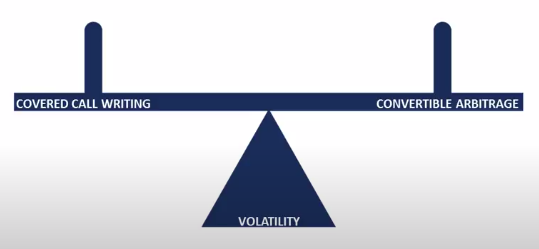

So as I drill through the strategies we'll talk about the fact that we have the two complementary strategies the

- Convertible arbitrage and

- Cover call writing

the picture I always like to paint is a proverbial seesaw that you grew up playing with on the playground will put convertible arbitrage on one side of the seesaw cover call writing on the other and you can think of volatility as kind of being that fulcrum point in the middle.

The idea is that these strategies complement each other extremely well convertible arbitrage.

I would describe both of these strategies, by the way, will work well in a variety of different market environments.

But convertible arbitrage I would describe as more of a long volatility strategy.

Volatility is increasing it's going to create a lot of opportunities for us to rebalance our convertible hedging.

Cover call writing, on the other hand, is more of what we call a short volatility strategy.

When you sell a call option and volatility Falls the probability of getting to a strike price, and it makes the value of the options fall.

So you're profiting when you sell that call option in that environment.

Having those two strategies let me drill down on each of these strategies individually we'll start with

Convertible Arbitrage Strategy

The convertible arbitrage strategy starts by a long convertible bond position.

A convertible bond is a bond that has the right to exchange the bond for the underlying stock hence called a convertible. You can convert the bond into the underlying stock.

What we're trying to take advantage with convertibles is the idea that because you have that right to own the stock.

As the stock price is going up the convertible is gaining more and more equity sensitivity, as that option to convert of the stock is getting closer to and above the conversion price that the convertible converts into.

On the way down however the convertible bond has a bond component like any other bond the bond will mature at par essentially creating a put at par for the bondholder and underneath the convertible.

So, as the stock price is going down the convertible is actually shedding some of that equity sensitivity.

So the idea is we're trying to take advantage of that asymmetric upside downside relationship.

So you can see as the stock price goes up this slide by the way we're looking at is the stock price on the bottom relative to the bond price on the vertical access.

You can see that the convertible really has two functions one is the value that the convertible would be worth if it converts into the underlying stock that's labelled as the diagonal line here called conversion value the other value we have is called the bond value.

The investment value that's the value the convertible if we just set that conversion option aside. So you can see what's happening is as the stock price goes up the convertible is tracking closely with the underlying stock that it converts into.

But when the stock price goes down the bond value acts there to hold the price up. The idea that you have this asymmetric upside downside profile with the convertible relative to the common stock that it converts into is what we're trying to take advantage of in the relationship.

Here talk about four opportunities that convertible arbitrage will provide:

1. we can receive the coupons on the convertibles in the portfolio, so convertibles like many other bonds pay coupon payments.

the fun does not utilize leverage and what that means is that when we short the underlying stock and receive the cash proceeds, we're not taking that cash and buying more convertibles and levering it up and up the strategy.

0 Comments